|

|

In 2022, faced with the severe and complicated external environment, Sinopec followed the guidance of Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era, the spirits of the 20th CPC National Congress, Xi Jinping Strategic Thought on Energy Security, and the Important Instructions during the inspection tour to Shengli Oilfield, firmly implemented the Party Central Committee’s policies on foreign affairs, shouldered responsibilities, strived to overcome difficulties, fixed on deepening international cooperation, and engaged in global market competition, prioritized markets along the BRI, improved global business layout, and took on fresh steps towards the international operations of Sinopec.

Overseas Oil and Gas E&P

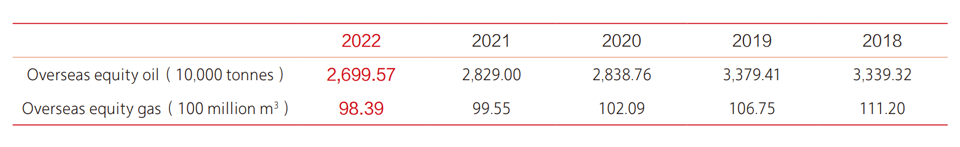

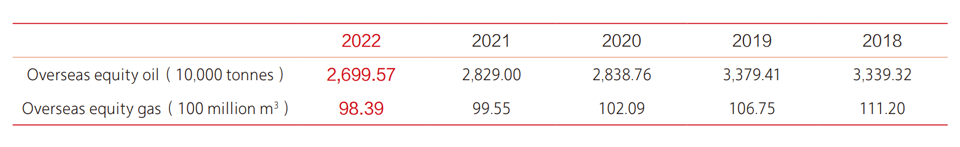

As of the end of 2022, we had invested in 44 oil and gas exploration and development projects in 23 countries, forming an overall overseas oil and gas strategic layout that combined oil and gas, onshore and offshore, and conventional and unconventional diversification. Throughout the year, we completed 200 square kilometers of 3D seismic acquisition, 42 exploration and evaluation wells, and achieved 1 exploration breakthrough, 8 new exploration discoveries, and 2 new exploration progress in Angola, Egypt, and other regions. The newly added equity 2P reserves and 2C resources reached 9.16 million tonnes of oil equivalent, exceeding our annual targets. We focused on key production areas, strengthened efficient well location demonstration and engineering technology innovation, strived for early deployment, early production, and early effectiveness, with a newly built equity production capacity of 3.26 million tonnes, and the current production contribution of the new capacity of 1.59 million tonnes and a production contribution rate of 48.8%, significantly exceeding the annual target. We took the initiative to develop new projects, enhance communication with the governments, NOCs, and IOCs of resource-rich countries, expand cooperation opportunities, and accelerate the disposal of inefficient and ineffective assets, achieving substantial progress in key operational projects, and continuously optimizing the asset structure.

Overseas Petroleum Engineering and Technical Services

We actively responded to the unfavorable conditions of Covid-19 outburst overseas, grasped the favorable conditions of relatively high international oil prices and the rebound of owner investment, meticulously worked and pressed forward, and brought the overall overseas business into a positive and upward development. By the end of 2022, we had carried out petroleum engineering technical services in 35 countries, and 332 contracts with a contract value of 17.51 billion dollars were being. Throughout 2022, 74 new contracts were signed with a contract value of 2.32 billion US dollars, and 83 contracts were completed with a contract value of 1.93 billion US dollars, outperforming our plan.

Overseas Refining and Chemical Joint Ventures and Cooperation

We are engaged in investing in 8 refining and storage projects in 5 countries, with a total investment of approximately 11.771 billion US dollars. We have an overseas refining capacity of 7.5 million tonnes/year, a storage capacity of 1.36 million cubic meters, a lubricating oil capacity of 80,000 tonnes/year, and a nitrile rubber capacity of 10,500 tonnes/year. The Amur Natural Gas Chemical Project under construction in Russia is a showcase of Sino-Russian petrochemical cooperation, with a designed production capacity of 2.3 million tonnes/year of polyethylene and 400,000 tonnes/year of polypropylene.

Overseas Refining and Chemical Engineering Services

We managed to cope with the impact of Covid-19 and the complex and ever-changing external market environment. The refining and chemical engineering sector has actively expanded its market, making new breakthroughs in the African and Middle Eastern markets, and steadily advancing the execution of other projects. As of the end of 2022, 70 refining and chemical engineering technical service projects had been carried out in 16 countries, mainly covering design, EPC, and construction projects. 92 contracts were under execution with a contract amount of 6.08 billion US dollars. A total of 114 contracts have been executed, with a contract value of 6.805 billion US dollars. A total of 51 contracts have been completed, with a contract amount of 642 million US dollars and accumulated profit of 32 million US dollars.

International Trade

To ensure stable energy supply, we continued to strengthen strategic cooperation with oil producing countries and suppliers, and strived to obtain cost-effective crude oil resources from around the world. In 2022, the total international trade volume of oil and gas was 365 million tonnes (including carbon trading), a decrease of 36.12 million tonnes or 9%. The operating volume of crude oil was 294 million tonnes, a decrease of 29.42 million tonnes or 9.09%. Crude import was 203 million tonnes, a decrease of 4.53 million tonnes, down by 2.10%. The third-party trade volume in crude was 91 million tonnes. The operating volume of refined oil products was 50.55 million tonnes, a decrease of 60,000 tonnes, basically flat. Export of refined oil products was 23.46 million tonnes, an increase of 990,000 tonnes, up by 4.4%. The third-party trade volume in refined oil products was 24.82 million tonnes. The annual import of LNG was 15.67 million tonnes (equivalent to 22.4 billion cubic meters), a decrease of 2.42 million tonnes (equivalent to 3.5 billion cubic meters), down by 13.4%. Third-party trade in LNG was 2.25 million tonnes (equivalent to 3.5 billion cubic meters).

In 2022, the overseas trade volume of chemical products reached 6.54 billion US dollars, an increase of 56%. The total operating volume reached 5.688 million tonnes, up by 10%. The international trade in equipment, materials, other refining and sales by-products, and other chemical products reached 1.055 billion US dollars, a drop of 22.71%. The overseas sales (shipment) of catalysts amounted to 24,098 tonnes, registering 147.61 million US dollars, up by 86.58%, which hit a historic high and achieved an upward trend. The total overseas trade volume of lubricants in China was 317 million US dollars, with a total operating volume of 196,000 tonnes. In addition, the transaction amount of EPEC International Business Platform stood at 21.75 billion US dollars.

International Joint Ventures and Cooperation within China

In response to a wider opening up to the outside world and stabilizing foreign investment, we actively carried forward the implementation of key domestic international joint ventures and cooperation projects, and facilitated Sinopec’s chemical business to achieve differentiated development with higher added value. In 2022, we successfully acquired 50% equity of Ineos Ningbo ABS Company and established a joint venture. In addition, in order to upgrade the product structure of SECCO, optimize raw material supply, and improve management, we introduced strategic investors through joint venture cooperation, sold 50% of SECCO’s equity to Ineos, and established a joint venture.

To enhance green and low-carbon international cooperation, Sinopec signed an MoU for cooperation with Shell, BASF, and Baowu at the 5th China International Import Expo, and jointly launched China’s first open ten-million tonne CCUS project in East China. We carried out domestic oil and gas joint ventures such as the Shengli Chengdao West Exploration and Development Product Sharing Project and the Sanjiaobei Coalbed Methane Project, with a total of 10.4186 million tonnes of oil delivered in the cooperation blocks, of which the share of Chinese operators reached 4.9735 million tonnes. The cumulative gas production was 780 million cubic meters, of which the share of Chinese operators was 65.84 million cubic meters.

Our Operations Outside China’s Mainland

|

|

|

|

|

Address

Address Post code

Post code Tel

Tel 京公网安备11010502035639

京公网安备11010502035639